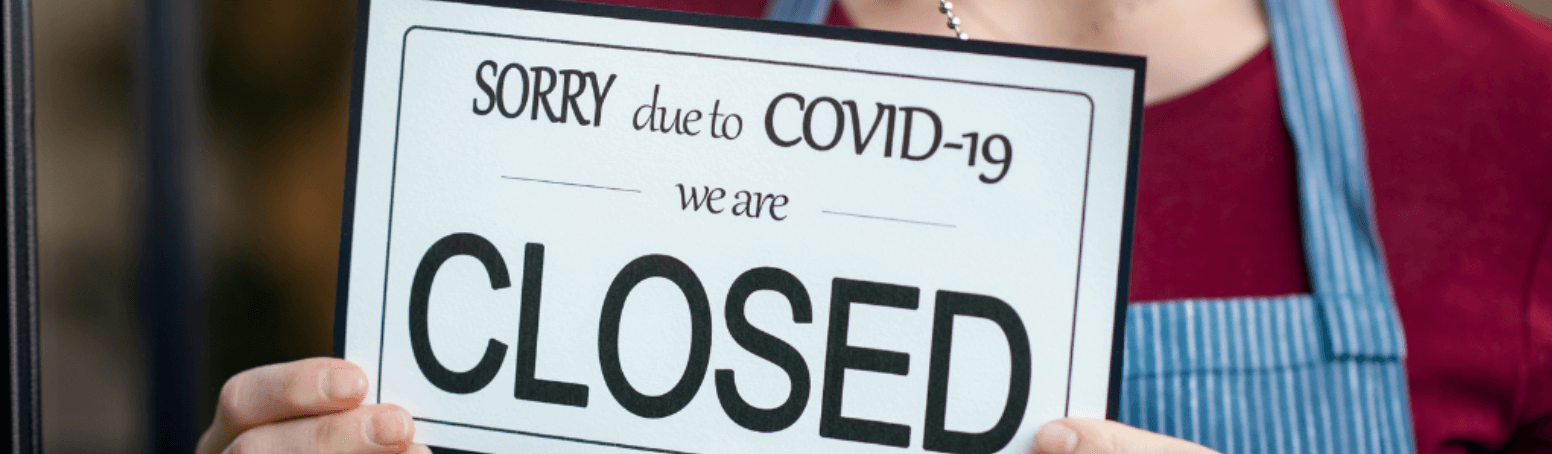

Deadline looming: March 2026 is the deadline to bring a Covid-19 Business Interruption Insurance claim against your Insurer.

We are acting for thousands of policyholders to recover losses as a result of forced closures and loss of trading. Do you think you could have a claim? Reach out to the team today. Time isn't on your side but we are.

When the unexpected disrupts your business, having insurance in place acts as peace of mind to ensure your business is uninterrupted. But what if your insurers don’t support you when you need them? We come across this situation all too often; insurance companies reject claims that should be paid under the policy.

Unfortunately, insurers are all too keen to find loopholes to prevent paying their policyholders what they’re owed, leaving you with crippling costs and potential liquidation.

Here at RLK, we help you secure the compensation you’re entitled to. As specialists in Business Interruption Insurance (BII) claims, we’re at the forefront of this evolving legal field and experts when it comes to challenging insurers.

We have the knowledge, innovation and relentlessness to fight for what’s owed to you, so you can focus on rebuilding your business. Our proven track record includes successfully overturning thousands of insurer denials for businesses across the UK.

Whether your claim has been declined or ignored, we’re here to challenge it on your behalf.